Career Focus:

Underwriter

Do you enjoy working with others? Do you have good email and phone communication skills? Are you detail-oriented? Do you like following the rules?

An underwriter position might be right for you.

What is an Underwriter?

An underwriter is responsible for reviewing, analyzing, and inspecting insurance documents. An underwriter takes ownership over their agencies to guide them through the intricacies of the Multi-Peril Crop Insurance programs.

What Will I Do?

Provide exceptional customer service to agent partners.

Answer calls and emails from agents.

Research agent questions and concerns.

Evaluate insurance documents such as applications, production reports, acreage reports, etc.

Meet deadlines established by the Risk Management Agency’s policies and procedures.

Confirm the accuracy of information provided by agents and entering it into the computer system.

Conduct policy reviews of documentation.

What Skills Will I Need?

Basic keyboarding skills.

Ability to learn and understand policy information.

Ability to understand questions and provide correct and courteous answers.

Ability to learn and apply company terminology, processes, and systems.

Ability to work well with people in a team environment.

Ability to conduct quality oral and written communication.

Ability to utilize analytical thinking – to find facts and solve problem.

Ability to maintain a positive attitude when dealing with problems, stress, or conflict.

Ability to manage multiple tasks.

A Day in the Life of an Underwriter

Brenda is an Underwriter II with AgriSompo. Follow along below as she walks you through a typical day in her role.

Morning

Brenda begins her day by checking email and phone messages. Her correspondents include agents, her supervisor, her team lead, and other underwriters. She responds right away to any urgent requests.

Mid-Day

Once her email and phone inboxes are clear, she moves on to check her batches. Batches include the paperwork agents have provided to her for review. This paperwork can include applications, production reports, acreage reports, and multiple other types of documents.

She also spends time during the middle of her day reviewing special policies that require additional information and/or processing.

Wrapping up the Day

Brenda runs specific forms each day before leaving the office. It’s important to do so to avoid holding up any potential indemnity claims that may need to be processed and paid.

She also checks her email and phone messages again at this point to confirm all urgent needs were taken care of during her workday.

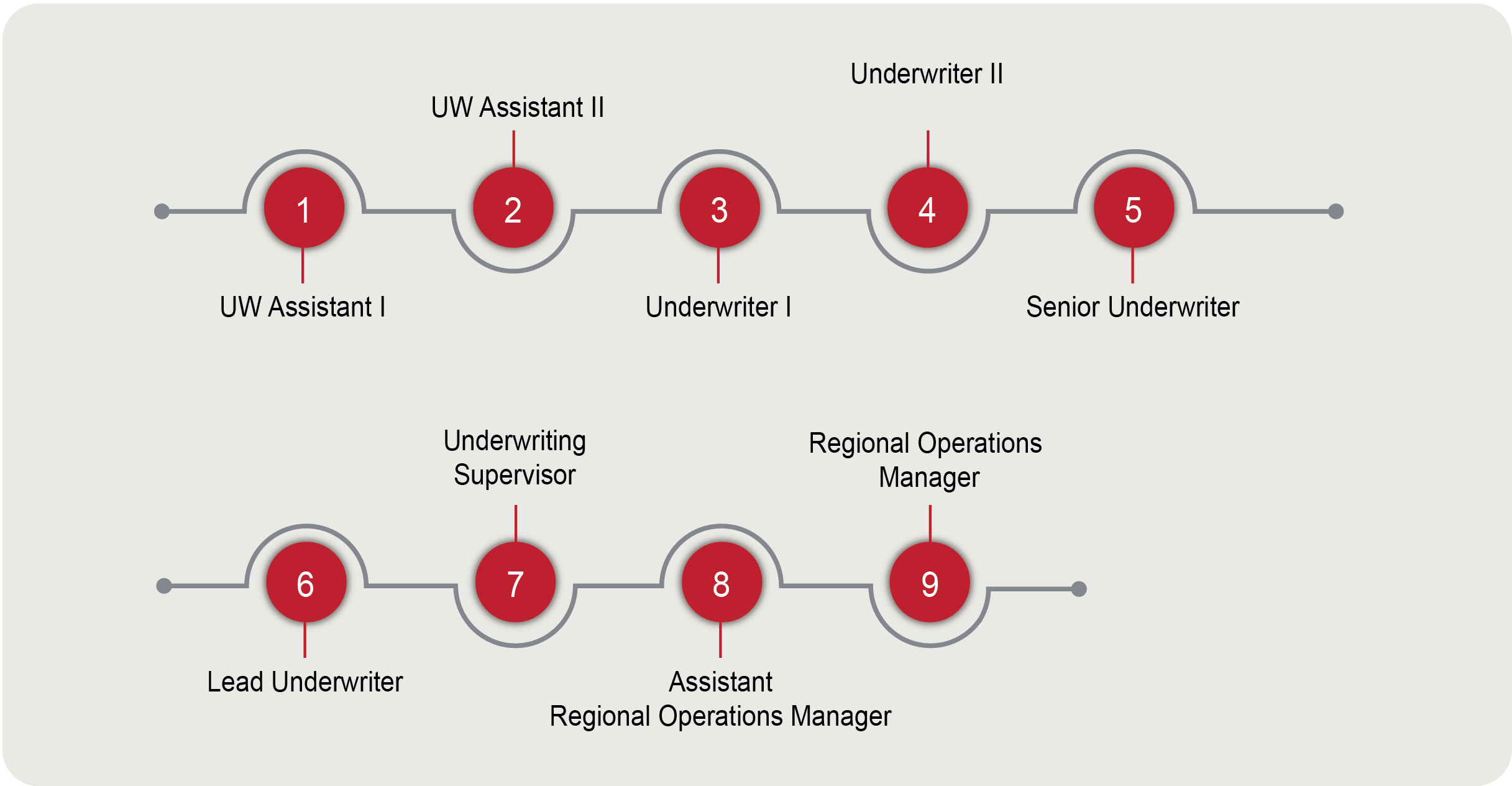

Career Trajectory

An underwriter generally progresses through their career along the trajectory outlined below.

Interested in a career as an underwriter?

Follow the link below to see which positions AgriSompo has available.

Click Here