Become a Per-Diem Adjuster

Do you want to be your own boss and set your own hours?

Do you enjoy working outside? Does the idea of working from home without going into an office excite you?

Are you detail-oriented? Are you a “people person" that would enjoy getting to know farmers and ranchers?

A position as a per-diem adjuster at AgriSompo might be right for you.

What is a Per-Diem Adjuster?

An adjuster is responsible for adjusting crops for Multi-Peril Crop Insurance (MPCI), Private Products (crop hail), and Named Peril claims within their given territory. Servicing customers (both policyholders and agents) is their top priority.

As a per-diem adjuster,

What Will I Do?

Build and maintain professional relationships with the Area Claim Supervisor (ACS), policyholders, agents, and other adjusters.

Record and transmit loss information to accurately determine potential damages in accordance with established loss adjustment procedures (FCIC, NCIS, and Company).

Complete field inspections, read maps and aerial imagery, and measure fields and storage bins.

Utilize company software proficiently, including daily monitoring of all company communications (email, Webex, text, etc.).

Follow FCIC, State, and Company rules and regulations, policies, and procedures for MPCI and Private Products.

Complete initial and ongoing training and certifications as required by FCIC and State Regulations.

Explain adjusting procedures and related findings to the policyholder and agent.

Perform fact-finding tasks and investigate crop damage, record information, and transmit information to accurately determine potential indemnities.

Have a willingness to learn about new crops.

Work out of a home office.

What Skills Will I Need?

Basic mathematical skills (add, subtract, multiply, divide).

Effective interpersonal, oral, and written communication skills with the ability to interact with all levels of people within and outside the organization.

Ability to complete documentation requirements.

Ability to utilize analytical thinking: find facts and solve problems.

Ability to remain self-motivated and efficient.

Ability to work both in an office setting (when necessary) and outdoors in a farm environment.

Ability to work well both independently and within a team environment.

Ability to remain focused on exceptional customer service, both internally and externally.

Working knowledge of crop insurance regulations, policies, procedures, and best practices.

Ability to work effectively under pressure and within tight deadlines.

Willingness to take initiative and work with minimal supervision.

Strong time management skills with ability to prioritize.

A Day in the Life of an Adjuster

Nathan is a Technical Adjuster Specialist with AgriSompo North America. Follow along below as he reflects on his career, a typical day in the life of an adjuster, and the yearly cycle of the crop insurance industry.

When I first started in the crop insurance industry straight out of college, I had the same nervous energy that I think most experience when getting out into the real world. I had no idea what to expect, and was anxious to see how I would adapt.

Through the years, I've learned so much from coworkers, supervisors, and myself. When you're in the agricultural space while working from home, you learn a lot about what works for you. My advice: try to develop a pattern of workflow, make lists so you can cross things off, and get a comfortable desk chair for your home office.

If you're a self-starter who is interested in a flexible rewarding job in the agricultural space, becoming a claims adjuster just may be the right thing for you! I didn’t know what I wanted to do out of college, but here I am 12 years later.

Morning

Coffee and emails! I also usually finalize my schedule if I have any on-farm visits for the day. If I just have office work to do, I jump right into it and go hard until 11 a.m. I follow that up with an hour at the gym, a quick snack when I get home, and then I'm back into paperwork.

I like to get out and get my field inspections done in the morning to avoid any hot weather. Walking through a corn field is a lot easier when its 75 degrees, rather than 95 degrees.

Mid-Day

Field appraisals: I try to line up as many farmers as I can in an efficient manner, while juggling their schedules as well.

Office work: An office with triple monitors is a life-saver. I grind out as many tickets and others tasks as I can while listening to podcasts or music.

Wrapping Up the Day

I make notes, update reserves, and write down the claims on my log every day so I don’t have to scramble on a random Friday or at the end of the month to put a report together.

I also usually make my first appointments for the next day the night before, while trying not to lock myself into a crazy tight schedule. Most of my farmers know me, and know that I will get to them as soon as possible, so they're very understanding of my getting to as many of them as I can during a day while maintaining a reasonable workload.

The Yearly Cycle for an Adjuster

The crop insurance season goes through many stages over the course of a year, usually starting in April with wheat appraisals. Early wheat appraisals will eventually give way to replant inspections, when anxious farmers are trying to get their corn in the ground.

After corn replant season, keep your eye to the sky for springtime hail storms that can affect a variety of crops all the way up to wheat harvest. Once the wheat claims are finished, and you continue through summer finishing corn and soybean replants, you will find yourself smack dab in the middle of corn silage season.

Mid-august (depending on the weather) can be a little overwhelming! You may have fields with drought, hail, or flood to inspect, while dealing with several farmers who all want to chop silage the same day. Don’t worry – that’s why we have RSA forms!

After silage season is over and harvest gets going, so will the harvest claims. The period from October through March will mostly be measuring bins, typing in tickets, and finalizing the last of your claims for the year.

The feeling of getting through another year is a rewarding one so I like to kick back in the “off season” of late winter/spring to spend time with friends and family. But don’t get too comfortable because adjuster schools and hail trainings will consume some of that time as well.

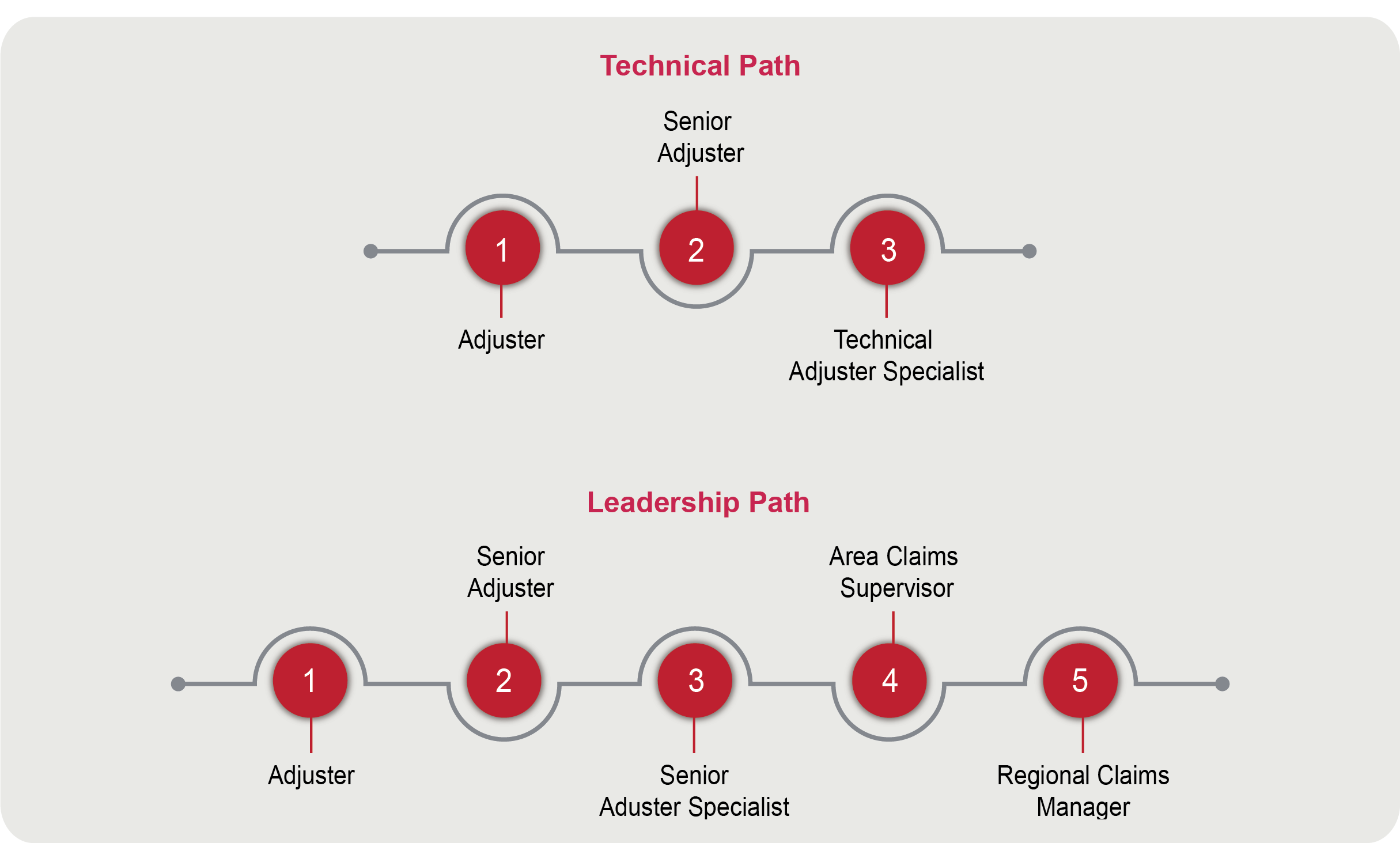

Career Trajectory

An adjuster generally progresses through their career in one of two ways: along a Technical path or a Leadership path.

Interested in a career as an adjuster?

Follow the link below to see which positions AgriSompo North America has available.

Click Here